With high-rise skyscrapers, Michelin-star gourmet bistros, and adrenaline-induced desert safaris, it’s no wonder the world is drawn to this glamorous metropolis. Dubai has been declared as the world’s most popular destination for 2022 and ranked the fourth best place in the world to invest in a holiday home. The UAE first began introducing holiday home regulation and monitoring laws in 2016 for individual owners. Since then, the holiday homes market in the UAE has experienced significant growth, particularly since the beginning of the Covid-19 pandemic.

Effect of Staycation Boom on Short-Term Rentals

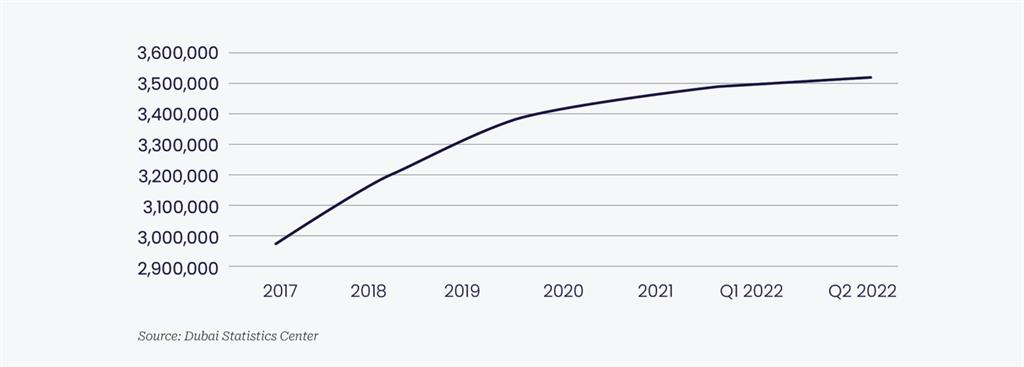

Moreover, because of the efficiency with which the UAE government handled the pandemic, it effectively encouraged people from all over the world to relocate to the country, especially to Dubai. At the same time, this has also led to a boost in tourism and promoted Dubai as one of the most popular work-from-home destinations.

Dubai was declared as the world’s most popular destination for 2022, ranking ahead of bustling cities like London, Rome, and Paris. The title was earned upon the release of Tripadvisor's Travellers' Choice Awards for 2022: The Best of the Best Destinations. Dubai was also ranked the 4th best place to invest in a holiday home among the top 50 global destinations as per research from Compare the Market (September 2021). The grading was done based on the following factors: weather, crime rates, entertainment, number of restaurants, cost of living, and property prices.

Why Invest in Holiday Home Property

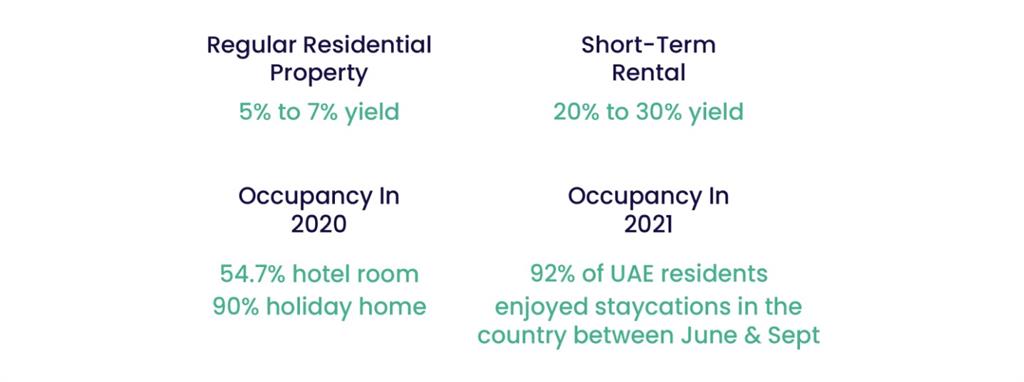

One of the advantages of holiday homes being an ideal investment is the flexibility for the owner to use the property when it’s not occupied. Holiday homes are also more flexible in terms of revenue gains since landlords with regular leases cannot increase rental rates for existing tenants by more than 20% as per Decree No. (43) of 2013, article 1 of RERA (Real Estate Regulatory Authority of Dubai) rules. However, short-term rentals can be more beneficial to investors since the contracts offer more flexibility to the landlord especially for communities that are still developing.

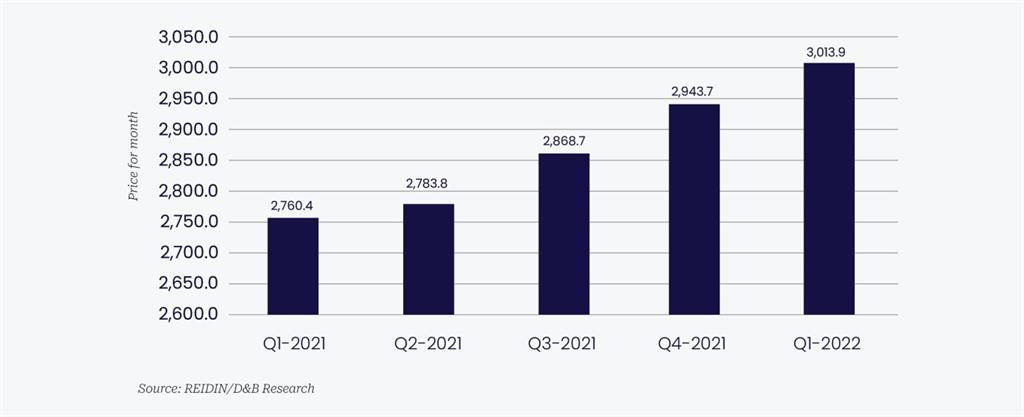

One other key factor is the net profitability of holiday home investments. Real estate investments in Dubai typically will yield between 5-8% returns, however holiday homes earn significantly higher returns by about 20-30% as shown in The National (June 2022), depending on the location and type of property.

Top 3 Holiday Homes Communities in Dubai

It is important to keep in mind that location is and always will be a key factor for investors to get the best return on investment. As per the analysis provided by our Be Our Guest Holiday Home department based on several queries and listings, the top 3 most popular locations for holiday homes in Dubai are:

1. Palm Jumeirah

2. Dubai Marina

3. Jumeirah Beach Residences

Finally, it is anticipated the demand for holiday homes will spike significantly due to the upcoming FIFA World Cup in Qatar in November and December 2022. This is the first ever World Cup hosted by a Middle Eastern country and is set to boost tourism across the Middle East. FIFA Tournament Time Demand Model (TTDM) has forecasted over 1.7 million spectators visiting Qatar to watch the World Cup.

Takeaways

Produced by D&B Properties & VAS

With nearly a decade’s experience in the UAE Real Estate market, D&B Properties is an acclaimed, award-winning firm and one of the leading brokerage companies in Dubai. Our success is defined by the gratification of our clients and the milestones we have achieved since our inception.

We have been recognized as the ‘Top Broker of Emaar’ in four consecutive years and have made premium collaborations with leading developers - such as Emaar, Nakheel, Dubai Properties, DAMAC, SOBHA - and listing platforms - such as houza, Bayut, Property Finder, and Yalla Deals.

Valuation & Advisory Services (VAS)

VAS produces comprehensive valuations of public or private real estate assets within MENA region, and provides consulting solutions to increase market value through detailed analysis and collated research

For more information:

.jpg)