From the first time the word cryptocurrency appeared online in 2009, to its first confirmed purchase at a pizza shop in 2010 using bitcoin (the most popular cryptocurrency on the market), this mode of exchange has grown tremendously. The rise of crypto has sparked mixed reactions in the UAE, but policymakers and investors are addressing this new phenomenon with a positive outlook.

Dubai has seen it all, from a real estate bubble to countless ICOs. These days, everyone is talking about cryptocurrency, and the UAE government seems to be taking control of the situation. UAE is pioneering innovative legislation and regulation to ensure virtual assets remain secure and provide clarity for the citizens of the nation. The possibilities for Blockchain in the region are endless, and if adopted properly, will improve numerous sectors across the board.

What is Cryptocurrency?

Crypto is a digital currency designed for online transactions that do not have a central regulatory body and instead use a decentralized system for transactions. Cryptocurrencies use cryptography to secure transactions, recording them on a blockchain similar to how traditional databases work.

Blockchain is a digital system, or a form of distributed ledger, in which a record of transactions made in cryptocurrencies are maintained across several computers, aimed essentially at having multiple points of control, rather than just one (decentralisation).

In 2008, Bitcoin was launched as the first cryptocurrency and since then, there is now over 10,000 cryptocurrencies in the world, as reported by Global Media Insight June 2022.

The Presence of Cryptocurrency in UAE

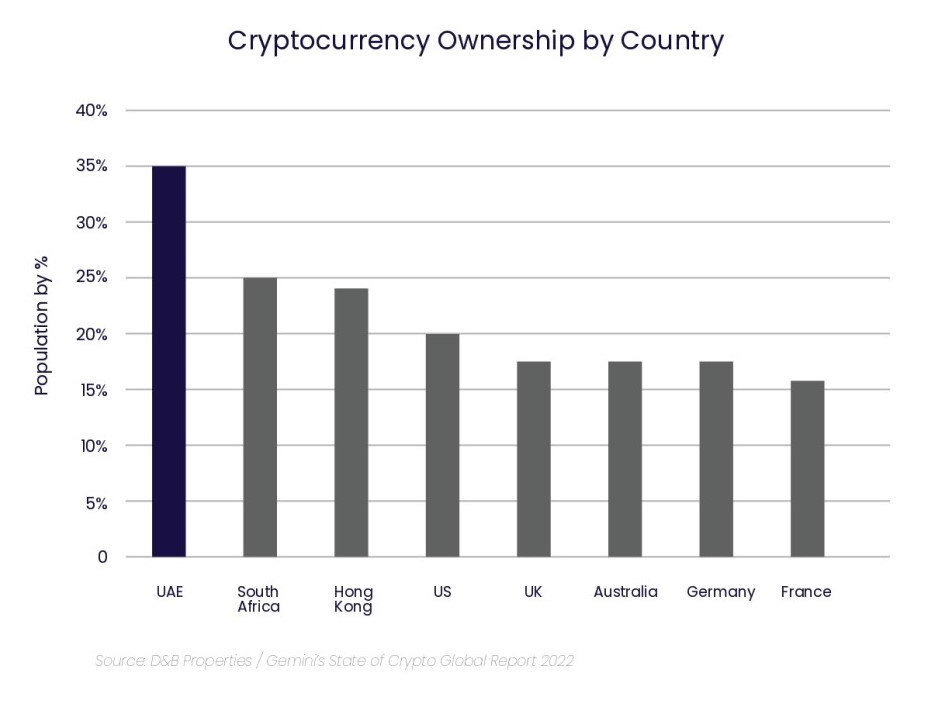

The Global Media Insight report notes that over 35% of the UAE population have already adopted cryptocurrency as a valid mode of payment. As per Zawya News (July 2022), a study conducted by Forex Suggest ranked UAE number 3 in terms of ‘Most Blockchain Start-ups’ and 4th for ‘Countries Most Interested in Cryptocurrency’.

Dubai is quickly becoming one of the top venues for trading cryptocurrencies due to its numerous rulings that encourage blockchain technology. While cryptocurrencies are not authorized by the Central Bank of the UAE nor accepted as legal money, they are not prohibited and can be traded on regulated platforms for crypto exchanges.

Regulating Virtual Assets in Dubai

UAE has become a pioneer in adapting to the changing world and economy. The first regulator of virtual assets is in the UAE known as ADGM’s (Abu Dhabi Global Market) Financial Services and Regulatory Authority (FSRA), and Dubai’s Virtual Assets and Regulatory Authority (VARA) is the first regulator with a presence in the Metaverse.

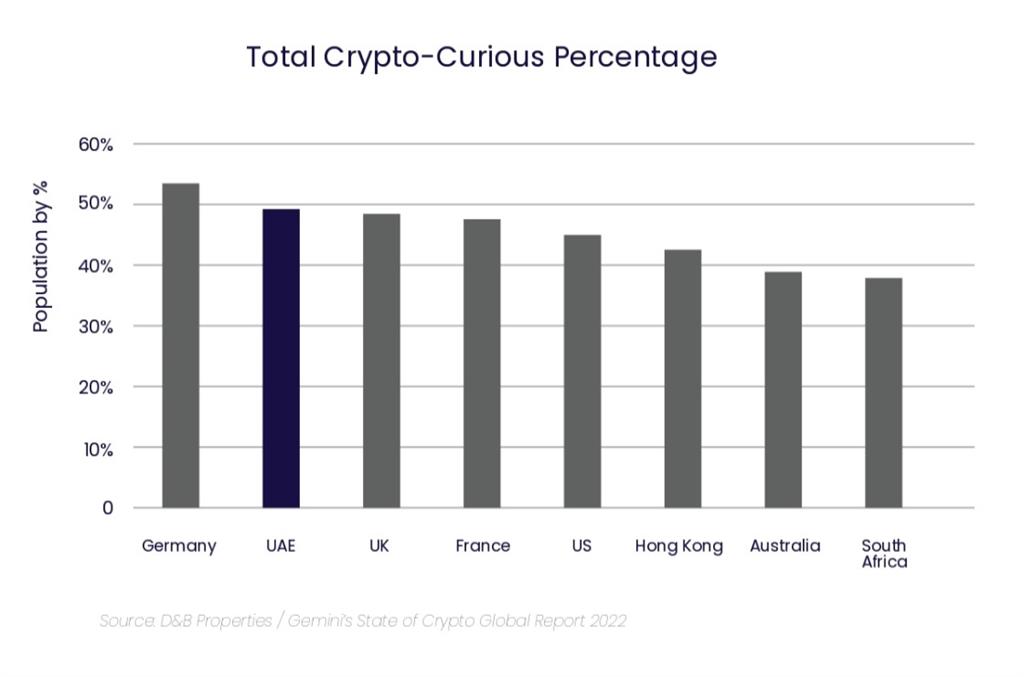

The establishment of VARA in early 2022 cemented Dubai as one of the fastest growing global hubs in the digital ecosystem, and ranked UAE in the top 10 countries with the ‘highest percentage of people who are curious about Cryptocurrencies’.

The VARA in Dubai granted Binance, a cryptocurrency exchange platform, a virtual asset license, allowing it to offer restricted exchange products and services to pre-qualified investors and licensed financial service providers. Bybit, another cryptocurrency exchange mentioned in the beginning of 2022 that it was relocating its headquarters from Singapore to Dubai, as reported by Global News Wire (March 2022).

A List of Popular Cryptocurrencies:

A List of Popular Crypto Exchange Platforms in UAE:

The recent launch of the metaverse strategy in Dubai, which aims to build and attract more than 1,000 companies in the fields of blockchain and metaverse, will create more than 40,000 virtual jobs by 2030 to boost the emirate’s economy and support the country’s vision to increase the number of blockchain companies in the country.

One of the greatest benefits of cryptocurrencies over fiat currencies (government-issued money like notes and coins that is not backed by a commodity) is that transactions using cryptocurrencies are simple, quick, and involve no third parties besides the platforms where the currency is traded. Cryptocurrency transactions are also not subject to government regulation.

A List of Popular Cryptocurrencies:

- Bitcoin

- Ethereum

- Tether

- USD Coin

- Binance Coin

- XRP

- Stellar

- Cardano

- Dogecoin

A List of Popular Crypto Exchange Platforms in UAE:

- BitOasis

- CoinMENA

- Binance

- Coinbase

- Kraken

- Baraka

The recent launch of the metaverse strategy in Dubai, which aims to build and attract more than 1,000 companies in the fields of blockchain and metaverse, will create more than 40,000 virtual jobs by 2030 to boost the emirate’s economy and support the country’s vision to increase the number of blockchain companies in the country.

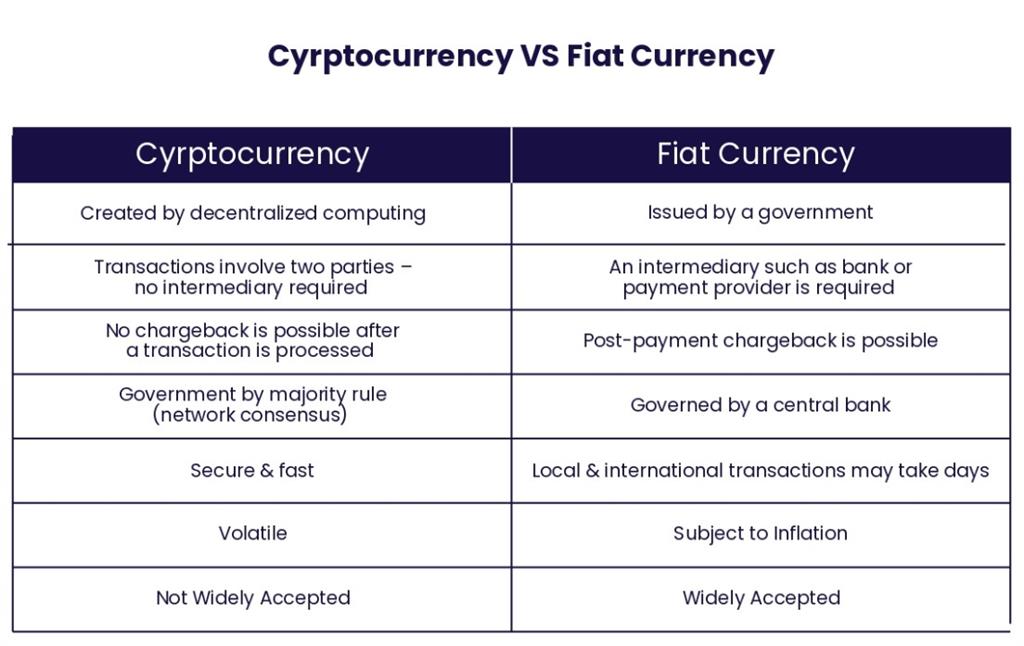

Crypto VS Fiat Currency

One of the greatest benefits of cryptocurrencies over fiat currencies (government-issued money like notes and coins that is not backed by a commodity) is that transactions using cryptocurrencies are simple, quick, and involve no third parties besides the platforms where the currency is traded. Cryptocurrency transactions are also not subject to government regulation.

Other benefits include low transaction fees, cryptocurrency interest rates, and other taxes which occurs in a normal exchange. According to CNBC (April 2022), the Middle East is one of the regions with the fastest-growing cryptocurrency markets, accounting for 7% of worldwide trading volumes. In addition, due to the cryptographic structure of cryptocurrencies, those regulatory authorities are unable to tax or access them without the owner's permission. This makes cryptocurrencies appealing to investors worried about privacy, crisis situations, general inflation, or hyperinflationary events.

Cryptocurrencies have a clear volatility risk as they are highly risky and speculative. Moreover, the transactions are anonymous and pseudonymous with no way to track where and when a transaction was issued for both senders and receivers. This makes it a good option for people to keep their transactions private. While this would be a benefit for private investors, digital currency could also easily be used for non-legal transactions such as potential tax evasion and money laundering.

Because of this, the UAE recently instituted enforcement. A recently introduced law aimed at preventing money laundering requires the real estate and legal sectors to record any payments made using virtual assets that are equal to or greater than Dh 55,000 ($14, 976) and payments where the cash utilized to complete the transaction came from virtual assets.

Although companies accepting cryptocurrency payments are still limited in UAE and are hardly used for retail transactions, businesses used cryptocurrency mainly for exchange and trading, with the real estate sector attracting the most attention. It seems clear that cryptocurrencies will have a big impact on how real estate is purchased in the future.

For the high- and ultra-high-net-worth cryptocurrencies users who are progressively making their way into the real estate market, Dubai seems to be the perfect location. Investors can set the price in fiat currency and then convert the funds to Bitcoin when buying real estate using cryptocurrencies. If they change it back to fiat currency when the transaction is over, property owners will not run the risk of volatility in pricing, as reported in Gulf News (June 2022).

Large master developers in the UAE are also now accepting crypto for real estate transactions. As reported in Arabian Business (April 2022), following a partnership between Nakheel and Hayvn (a digital asset focused financial institution), Nakheel customers may now pay their rent, service charges, and real estate acquisitions using cryptocurrency while other developers, such as Emaar and Damac, also offer cryptocurrency payments mainly using Bitcoin and Ethereum.

Cryptocurrencies have a clear volatility risk as they are highly risky and speculative. Moreover, the transactions are anonymous and pseudonymous with no way to track where and when a transaction was issued for both senders and receivers. This makes it a good option for people to keep their transactions private. While this would be a benefit for private investors, digital currency could also easily be used for non-legal transactions such as potential tax evasion and money laundering.

Because of this, the UAE recently instituted enforcement. A recently introduced law aimed at preventing money laundering requires the real estate and legal sectors to record any payments made using virtual assets that are equal to or greater than Dh 55,000 ($14, 976) and payments where the cash utilized to complete the transaction came from virtual assets.

Cryptocurrency in UAE Real Estate

Although companies accepting cryptocurrency payments are still limited in UAE and are hardly used for retail transactions, businesses used cryptocurrency mainly for exchange and trading, with the real estate sector attracting the most attention. It seems clear that cryptocurrencies will have a big impact on how real estate is purchased in the future.

For the high- and ultra-high-net-worth cryptocurrencies users who are progressively making their way into the real estate market, Dubai seems to be the perfect location. Investors can set the price in fiat currency and then convert the funds to Bitcoin when buying real estate using cryptocurrencies. If they change it back to fiat currency when the transaction is over, property owners will not run the risk of volatility in pricing, as reported in Gulf News (June 2022).

Large master developers in the UAE are also now accepting crypto for real estate transactions. As reported in Arabian Business (April 2022), following a partnership between Nakheel and Hayvn (a digital asset focused financial institution), Nakheel customers may now pay their rent, service charges, and real estate acquisitions using cryptocurrency while other developers, such as Emaar and Damac, also offer cryptocurrency payments mainly using Bitcoin and Ethereum.

While buyers for conventional lenders utilize the underlying property as collateral, crypto lenders use digital coins as collateral which can be a relaxed development for prospective homeowners whose main source of revenue is cryptocurrency. Using a crypto lender to acquire a mortgage gives buyers the freedom to freely use other assets that are not cryptocurrencies, which is ideal for investors who like to have different options thus giving advantage for buyers to utilize other assets without restriction.

In essence, cryptocurrency is a new type of digital currency that is rapidly gaining acceptance throughout the world, including the United Arab Emirates. The use of cryptocurrencies in the is anticipated to be made easier by Dubai's market, its dynamic economy, and its burgeoning digital industry. As an alternate payment mechanism, cryptocurrency payments will continue to have an impact on real estate investment practices. Additionally, it's possible that the government will adopt better regulations for using digital currencies in trade, particularly in the real estate industry. Dubai is renowned for putting new ideas into practice; therefore, the city is on the right path to provide cutting-edge solutions that will make it easier for investors to conduct cryptocurrency transactions.

Websites that facilitate trades between buyers and sellers are known as exchange platforms. They impose a minor transaction fee, varying from 0% to 5%. Important ones include Poloniex, Kraken, Bitstamp, Coinbase, and Bitstamp.

In essence, cryptocurrency is a new type of digital currency that is rapidly gaining acceptance throughout the world, including the United Arab Emirates. The use of cryptocurrencies in the is anticipated to be made easier by Dubai's market, its dynamic economy, and its burgeoning digital industry. As an alternate payment mechanism, cryptocurrency payments will continue to have an impact on real estate investment practices. Additionally, it's possible that the government will adopt better regulations for using digital currencies in trade, particularly in the real estate industry. Dubai is renowned for putting new ideas into practice; therefore, the city is on the right path to provide cutting-edge solutions that will make it easier for investors to conduct cryptocurrency transactions.

Cryptocurrency FAQ

1. Why Are Cryptocurrencies So Popular?

Many cryptocurrencies are "digital gold," which means they were developed to address issues with the current financial system. As a result, they have gained popularity among investors looking for alternate means of holding money. Their growing acceptance throughout the world and the fact that they are exchanged online are both significant factors in their popularity. Cryptocurrencies appeal to investors of all ages because they provide anonymity, simplicity of transfer, minimal transaction fees, and quicker processing times when compared to traditional banking systems.2. How Can I Buy Cryptocurrencies?

While buying cryptocurrency is actually quite straightforward, investing in them is a little trickier. You can accomplish it using mobile apps, ATMs, credit cards, payment processors, internet exchanges, and even cryptocurrency brokers. Most traders start trading on online exchanges since they are the simplest place to get started. Exchanges serve as meeting places for buyers and sellers to transact in different currencies. By using price charts on the platform to find offers, users purchase coins. They can then make a purchase by sending money directly to the seller's wallet address whenever they find a seller willing to sell for less than they paid. The buyer just sells the same amount back to the seller if they want to pay more than what was given.3. Where Are Crypto Wallets and Exchange Platforms Most Commonly Available?

You can keep Bitcoin, the first cryptocurrency, in a hardware wallet, software wallet, web wallet, or paper wallet. Hardware wallets are tangible objects that users can use to store their private keys. These often include USB sticks and smart watches and can be connected to a computer, smartphone, or tablet. Software wallets are programs that users can download to their PCs, mobile phones, or tablets and use to store their private keys. Users can keep their private keys on the cloud using web wallets. Printing out paper wallets allows for individual storage.Websites that facilitate trades between buyers and sellers are known as exchange platforms. They impose a minor transaction fee, varying from 0% to 5%. Important ones include Poloniex, Kraken, Bitstamp, Coinbase, and Bitstamp.

.jpg)