Dubai has emerged as one of the most popular investment destinations in the world due to its strong financial foundation and economy, adaptable policies, and overall safety environment.

The increase in investors and international expats making Dubai their permanent home has led to a rise in real estate transparency and an attractive residential and commercial property market. Furthermore, the Emirate's continuous development and implementation of new policies, reforms, and visa initiatives for foreign talent and investments make it an appealing destination.

Anticipated Developments & Trends in 2023

Key contributing factors for the Emirate’s development include a safe heaven, economic stability, new policies and reforms - such as business ownership, visa reforms for employment, residency, business related and medical. The provision of long-term visas for students, skilled employees, and affluent investors is one of many visa policy changes the UAE has made as part of a larger initiative to make the country more appealing and competitive for foreign talent, business firms, and investors, as well as the ease of doing business. Dubai International Financial Centre (DIFC) recently announced the establishment of the first Global Family Business and Private Wealth Centre in the world. This will result to increasingly family offices in the Emirate while contributing to employment rates growth and overall, the Emirate’s economy.

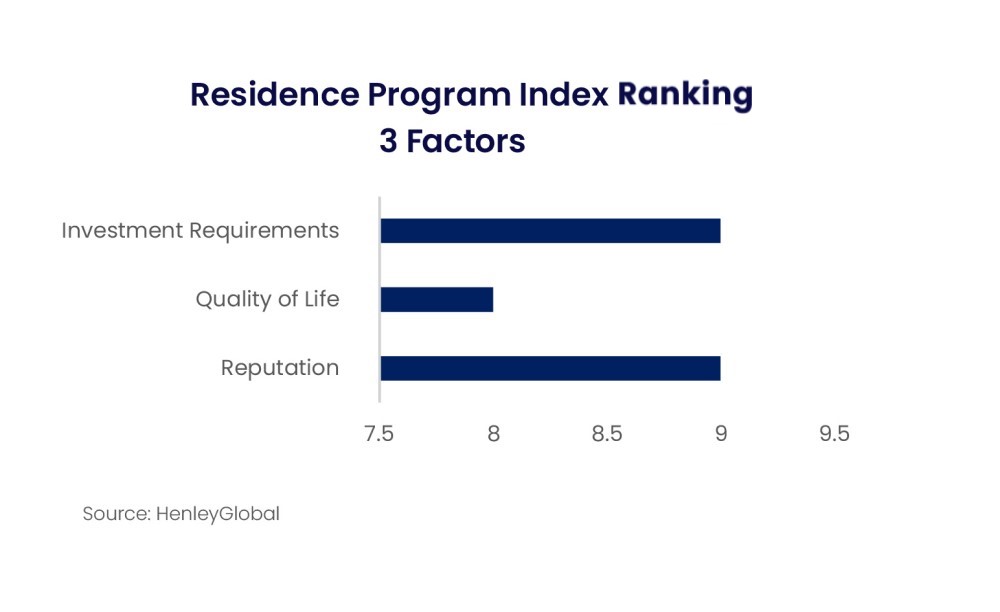

The graph above depicts UAE Global Residence Program Index measured on 3 factors: The UAE’s reputation, the country’s quality of life and investment requirements tractability. These factors are at the top of the list for investors and expats when looking to relocate. As per the above factors, the UAE Ranks the fourth and is stated to be better in those three areas than other countries such as Australia, South Korea, Portugal, Italy and Greece.

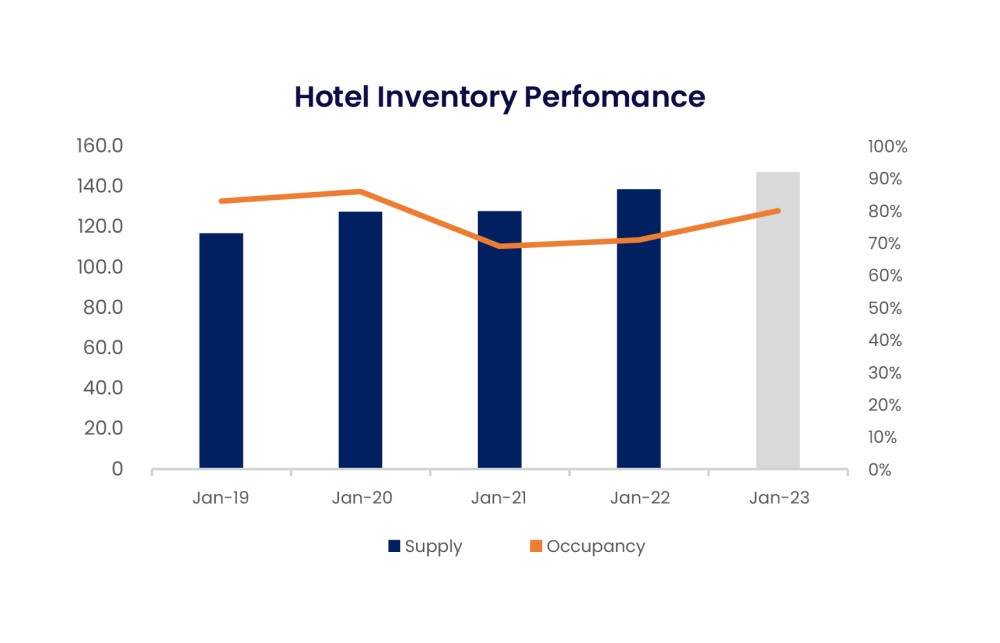

Furthermore, Dubai welcomed 14.36 million visitors in 2022, illustrating an increase of 17%, compared to 2021, and 17% less than pre-pandemic levels.

In January 2023, Dubai welcomed more than 1.47 million visitors, this is around 50% more, compared to the same period in 2022 at 0.98 million visitors. As a result, both occupancy levels and supply has increased in January 2023 compared to the same period last year while.

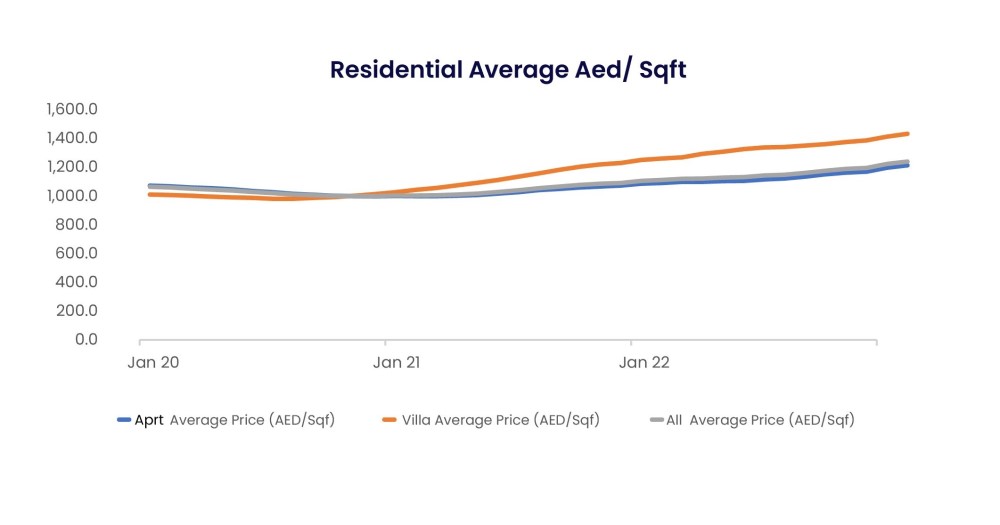

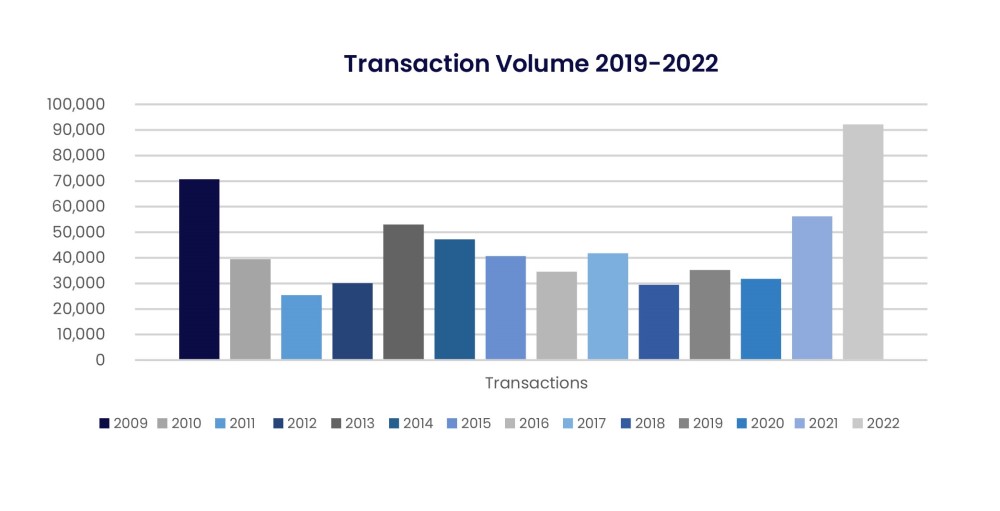

The residential market in Dubai displayed a positive performance in 2022, reflecting a high increase in prices and transaction volume for residential units. This is due to the influence of new trends and movement of UHNWIs. Residential properties reflected an average increase of around 10% compared to the previous year in 2021. It is important to note that the 2022 transactions volume reflected the highest amount since 2009.

However, 2023 to date reflects a transactions volume of around 28,000, depicting an increase of 46% compared to Q1 2022.

Anticipated Trends in Dubai 2023

- Dubai’s real estate market is anticipated to grow even further in 2023, despite rising interest rates, as most transactions are paid in cash.

- Due to the huge growth in the rental market, more lease extensions are being signed, as opposed to relocations, because of the rising cost of living. While purchasers and tenants are placing a greater emphasis on more affordable communities such as Discovery Gardens, Liwan, and Al Furjan. This trend is expected to continue due to residences opting for safe investment and fear of inflation, we are likely to see some of the affordable communities that are not fully mature attracting investors, due to new supply.

- Consequently, the interest of consumers is turning toward the apartment sector, because of the low pricing and the introduction of numerous new developments that offer cutting-edge residences in Dubai.

- The demand for luxury homes increased in 2022, while supply marginally were limited. Some of the expected luxury developments to be completed in 2023 include Da Vinci Tower, Jumeirah Living Business Bay and Mr. C Residences. We are likely to see this trend continue due to expected demand and reflected profitable for both developers and investors.

- Dubai’s commercial properties have witnessed an increase in demand, as Dubai became an attractive business hub post Covid19. The UAE’s strategy to curb Covid19 whilst investing heavily in technology alongside low inflation rates, economic stability, attractive investment products and environment has made the Emirate safe and attractive for business in general. This has resulted in high demand for grade A offices and large unit size warehouses. Following on from this, office supply is expected in the years 2023 to 2025 to amount to 2.45 m GLA (Sqft), with freeholds amounting to 1.7 million GLA (Sqft).

- The industrial and logistics property market in Dubai has also performed well post Covid19, driven by the growth of the e-commerce sector and the increasing demand for warehousing and distribution facilities. This trend is expected to continue in 2023, with the industrial and logistics property market projected to grow at a faster pace than the retail market. Dubai's strategic location as a logistics hub for the region also makes it an attractive destination for investors looking to invest in this sector.

Though a slight slowdown is anticipated in certain areas contributing to the Emirates’ economy, real estate developers are capitalizing on the current market conditions, with several major projects underway to attract investors worldwide and further boost Dubai's position as a leading investment destination.

Conclusion

In conclusion, Dubai's strong financial foundation, economy, adaptable policies, and overall safety environment continue to attract investors and international expats. The Emirate's continuous development and implementation of new policies, reforms, and visa initiatives for foreign talent and investments make it an appealing destination.

Despite rising interest rates, Dubai's real estate market is anticipated to grow even further in 2023, with a focus on more affordable communities and luxury developments. Dubai's commercial and industrial property markets are also expected to continue to grow due to the Emirate's strategic location as a logistics hub and attractive business environment. With several major projects underway, Dubai's position as a leading investment destination is set to further strengthen in the years to come.

.jpg)