Commercial real estate is a dynamic sector comprising diverse property types, each serving distinct purposes. Whether you're an investor or a business owner, understanding these categories is crucial. In this guide, we explore commercial real estate types, shedding light on their unique features and investment potential, from productive office spaces to consumer-oriented retail properties.

1. Office Spaces: Where Business Thrives

• Understanding Office Space

• Types of Office Buildings

• Investment Considerations

2. Retail Properties: Serving Consumer Needs

• The World of Retail Real Estate

• Types of Retail Properties

• Trends and Challenges

3. Industrial Real Estate: The Backbone of Commerce

• Unveiling Industrial Real Estate

• Types of Industrial Properties

• Investment Opportunities

4. Multifamily Properties: The Residential Side of Commercial

• The Dual Nature of Multifamily

• Types of Multifamily Properties

• Benefits of Multifamily Investing

5. Hospitality Real Estate: Where Travel Meets Comfort

• Embracing Hospitality Real Estate

• Types of Hospitality Properties

• Navigating the Hospitality Sector

6. Special Purpose Properties: Unique Ventures

• Exploring Special Purpose Properties

• Noteworthy Special Purpose Assets

• Special Considerations

7. Investing in Commercial Real Estate: Strategies and Tips

• Factors to Consider

• Due Diligence in Commercial Real Estate

• Investment Strategies

Conclusion: A Diverse World of Opportunities

Let's embark on this journey through the fascinating landscape of commercial real estate, starting with the spaces where businesses thrive.

1. Office Spaces: Where Business Thrives

Understanding Office Space

Office spaces are vital for business, offering physical settings for work, collaboration, and innovation. They vary in size and layout, from co-working offices to corporate headquarters.

Types of Office Buildings

• Class A Offices: These buildings are known for their prime locations, top-notch amenities, and high-quality construction. Class A offices attract blue-chip companies and often command premium rents.

• Class B Offices: Class B buildings offer good quality but are typically older or located in less prestigious areas. They provide a cost-effective option for businesses looking for functional office space.

• Class C Offices: Class C buildings are budget-friendly but may require renovations or improvements. They are suitable for businesses seeking economical office solutions.

Investment Considerations

Investing in office spaces can provide stable cash flow, as businesses typically sign long-term leases. However, factors like location, tenant quality, and market demand play pivotal roles in determining the success of office property investments. Due diligence is crucial to assess the potential risks and rewards.

2. Retail Properties: Serving Consumer Needs

The World of Retail Real Estate

Retail properties are the foundation of the consumer-driven economy, providing spaces for businesses to sell products and services to the public. These properties range from neighborhood shopping centers to regional malls and standalone stores.

Types of Retail Properties

• Shopping Centers: These encompass a wide variety of retail properties, including strip malls, community centers, and regional malls. They serve as hubs for shopping, dining, and entertainment.

• Standalone Retail: Single-tenant retail properties, such as standalone stores or restaurants, offer businesses the opportunity to establish a strong brand presence.

• Outlet Malls: Outlet malls focus on offering discounted products from well-known brands, attracting value-conscious shoppers.

Trends and Challenges

The retail sector has witnessed significant changes in recent years, driven by e-commerce and shifting consumer preferences. While challenges exist, such as the rise of online shopping, well-located and well-managed retail properties can still thrive. Diversification of tenants and adaptability to changing consumer behavior are key strategies for success.

3. Industrial Real Estate: The Backbone of Commerce

Unveiling Industrial Real Estate

Industrial real estate serves as the logistical backbone of the economy, providing space for manufacturing, warehousing, and distribution. These properties are vital for the movement and storage of goods.

Types of Industrial Properties

• Warehouses: Warehouses are large, open spaces designed for the storage of goods. They can be used for distribution, manufacturing, or as fulfillment centers for e-commerce companies.

• Flex Spaces: Flex spaces are versatile properties that can serve both office and industrial purposes. They are ideal for businesses that require a combination of office and warehouse space.

• Manufacturing Facilities: These properties are tailored for companies involved in production and manufacturing processes.

Investment Opportunities

Industrial real estate has experienced increased demand with the growth of e-commerce and the need for efficient supply chain operations. Investing in strategically located industrial properties can offer attractive rental yields and long-term stability.

4. Multifamily Properties: The Residential Side of Commercial

The Dual Nature of Multifamily

Multifamily properties, although primarily residential, fall under the umbrella of commercial real estate due to their income-generating nature. These properties consist of apartment buildings, condominiums, and townhouses.

Types of Multifamily Properties

• Apartment Buildings: These are multi-unit rental properties, ranging from small apartment complexes to large high-rises.

• Condominiums: Condos are individually owned units within a larger building or complex. Owners can rent out their units, providing an investment opportunity.

• Townhouses: Townhouses offer a balance between apartment living and single-family homes, making them an attractive choice for both renters and investors.

Benefits of Multifamily Investing

Multifamily properties offer a steady stream of rental income and the potential for long-term capital appreciation. Additionally, they can provide diversification within a real estate investment portfolio.

5. Hospitality Real Estate: Where Travel Meets Comfort

Embracing Hospitality Real Estate

Hospitality real estate comprises properties designed to accommodate travelers and tourists. This sector includes hotels, resorts, motels, and vacation rentals.

Types of Hospitality Properties

• Hotels: Hotels range from budget-friendly options to luxury resorts. They cater to a wide range of travelers, from business professionals to vacationers.

• Resorts: Resorts are typically located in picturesque destinations and offer extensive amenities, including pools, restaurants, and recreational activities.

• Vacation Rentals: Vacation rentals include properties rented out on a short-term basis, such as Airbnb listings and vacation homes.

Navigating the Hospitality Sector

Investing in hospitality real estate requires a keen understanding of tourism trends, location selection, and the management of guest experiences. It offers potential for lucrative returns, particularly in tourist-centric regions.

6. Special Purpose Properties: Unique Ventures

Exploring Special Purpose Properties

Special purpose properties cater to unique business needs and often require specific infrastructure or facilities. These properties serve a wide range of purposes, from healthcare to education and beyond.

Noteworthy Special Purpose Assets

• Medical Facilities: Properties such as hospitals, clinics, and medical offices fall into this category.

• Educational Buildings: Educational institutions, including schools and universities, require specialized properties.

• Religious Buildings: Churches, synagogues, mosques, and other places of worship are special purpose properties.

Special Considerations

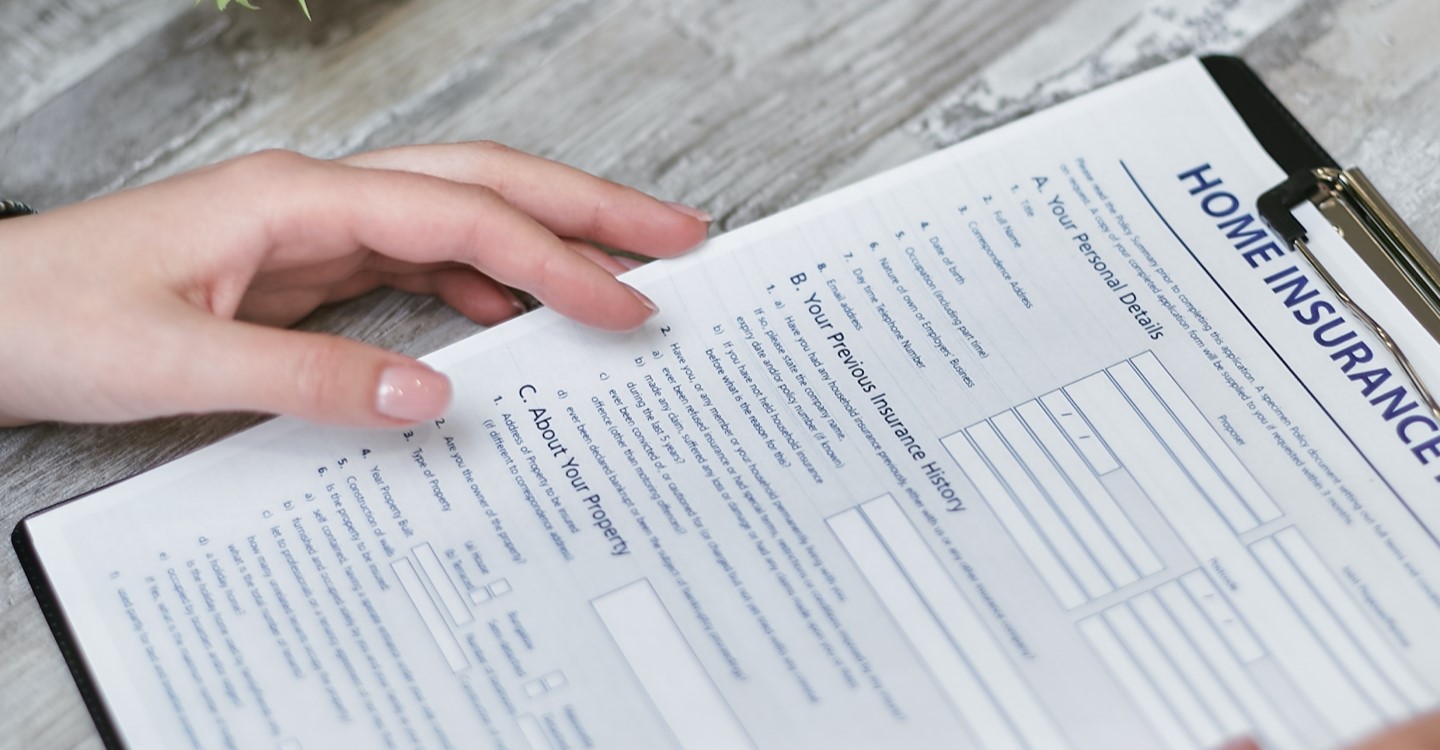

Investing in special purpose properties demands an in-depth understanding of industry regulations and compliance. Lease terms and tenant stability are crucial factors to consider.

7. Investing in Commercial Real Estate: Strategies and Tips

Investing in commercial real estate requires careful planning and a well-defined strategy. Here are some key considerations for success:

• Location Matters: Choose properties in prime locations with strong economic fundamentals and growth potential.

• Diversification: Diversify your portfolio across different property types and regions to mitigate risks.

• Due Diligence: Conduct thorough due diligence, including property inspections, financial analysis, and tenant evaluations.

• Professional Guidance: Seek guidance from real estate professionals, including brokers, attorneys, and property managers.

• Market Research: Stay updated on market trends, economic indicators, and local regulations.

• Financing: Explore financing options, including commercial real estate loans, to optimize your capital.

Conclusion: A Diverse World of Opportunities

The commercial real estate world offers diverse investment opportunities to meet various objectives and risk preferences. Whether you seek steady office space income, retail potential, industrial strength, multifamily stability, hospitality allure, or special purpose uniqueness, it provides numerous options.

Understanding the unique traits, challenges, and benefits of each property type empowers investors and entrepreneurs to confidently navigate the commercial real estate terrain. With a sound strategy, thorough research, and expert advice, you can tap into this exciting sector, expand your investment portfolio, and attain your financial objectives in commercial real estate.